Weekly Market Report

For Week Ending March 23, 2024

For Week Ending March 23, 2024

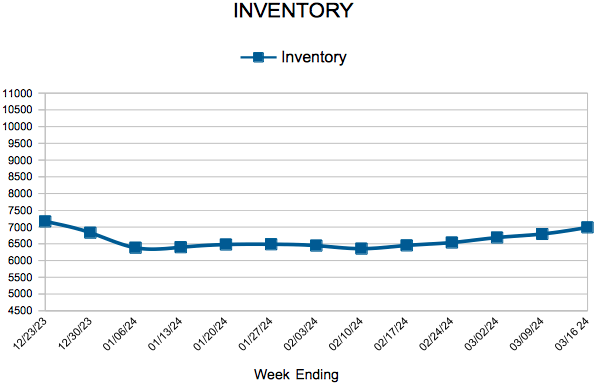

Housing inventory continues to improve nationwide, climbing 14.8% year-over-year according to Realtor.com’s February 2024 Monthly Housing Market Trends Report. New listings increased 11.3% year-over-year, while the total number of unsold homes rose 8.8% compared to the same period last year. Of particular note was the rise in inventory of homes in the $200,000 to $350,000 price range, which grew 20.6% annually, outpacing all other price categories.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MARCH 23:

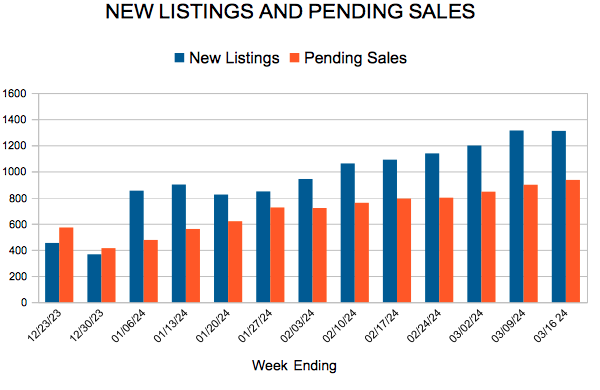

- New Listings increased 8.8% to 1,170

- Pending Sales increased 11.3% to 939

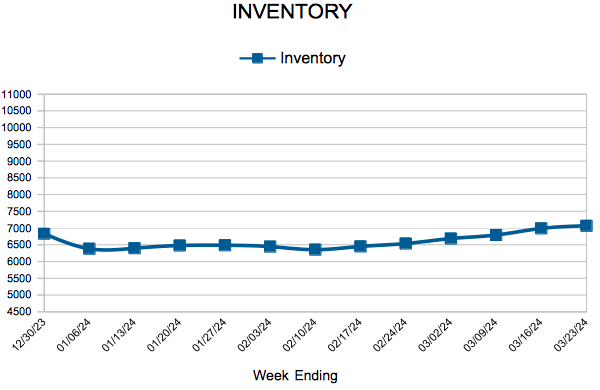

- Inventory increased 13.3% to 7,067

FOR THE MONTH OF FEBRUARY:

- Median Sales Price increased 4.6% to $358,000

- Days on Market decreased 3.3% to 59

- Percent of Original List Price Received increased 0.3% to 97.5%

- Months Supply of Homes For Sale increased 28.6% to 1.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

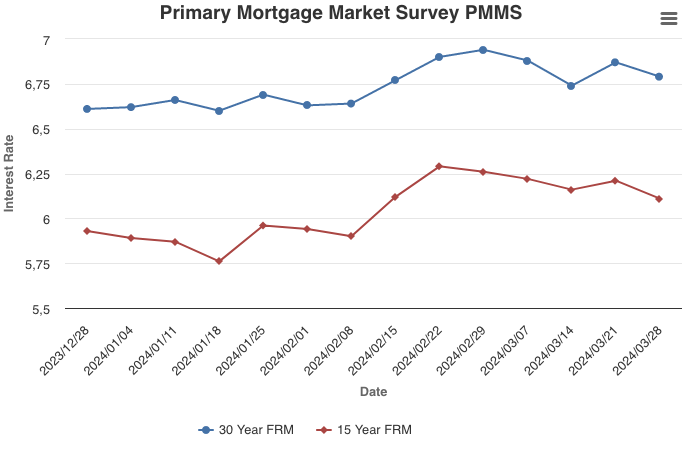

Mortgage Rates Drop Slightly

March 28, 2024

Mortgage rates moved slightly lower this week, providing a bit more room in the budgets of some prospective homebuyers. Additionally, encouraging data out on existing home sales reflects improving inventory. Regardless, rates remain elevated near seven percent as markets watch for signs of cooling inflation, hoping that rates will come down further.

Information provided by Freddie Mac.

February Monthly Skinny Video

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 37

- 38

- 39

- 40

- 41

- …

- 147

- Next Page »