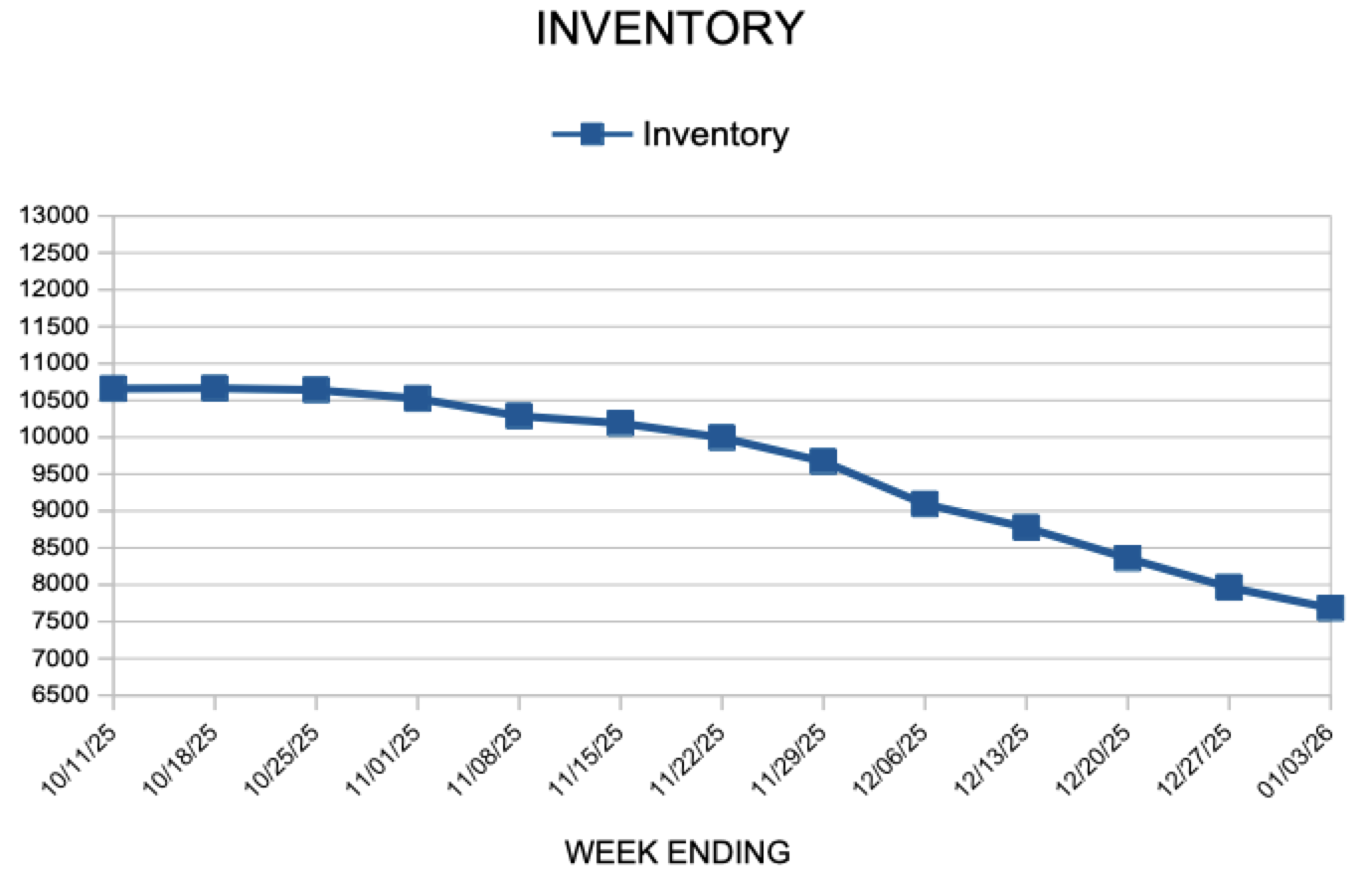

Inventory

Weekly Market Report

For Week Ending January 3, 2026

For Week Ending January 3, 2026

The National Association of REALTORS® (NAR) forecasts a 14% increase in existing-home sales in 2026, alongside a 5% rise in new-home sales. These gains are being fueled by steady job growth, softening mortgage rates, and improving overall market conditions. Home prices are projected to grow 4% this year, reflecting sustained demand and ongoing inventory constraints.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 3:

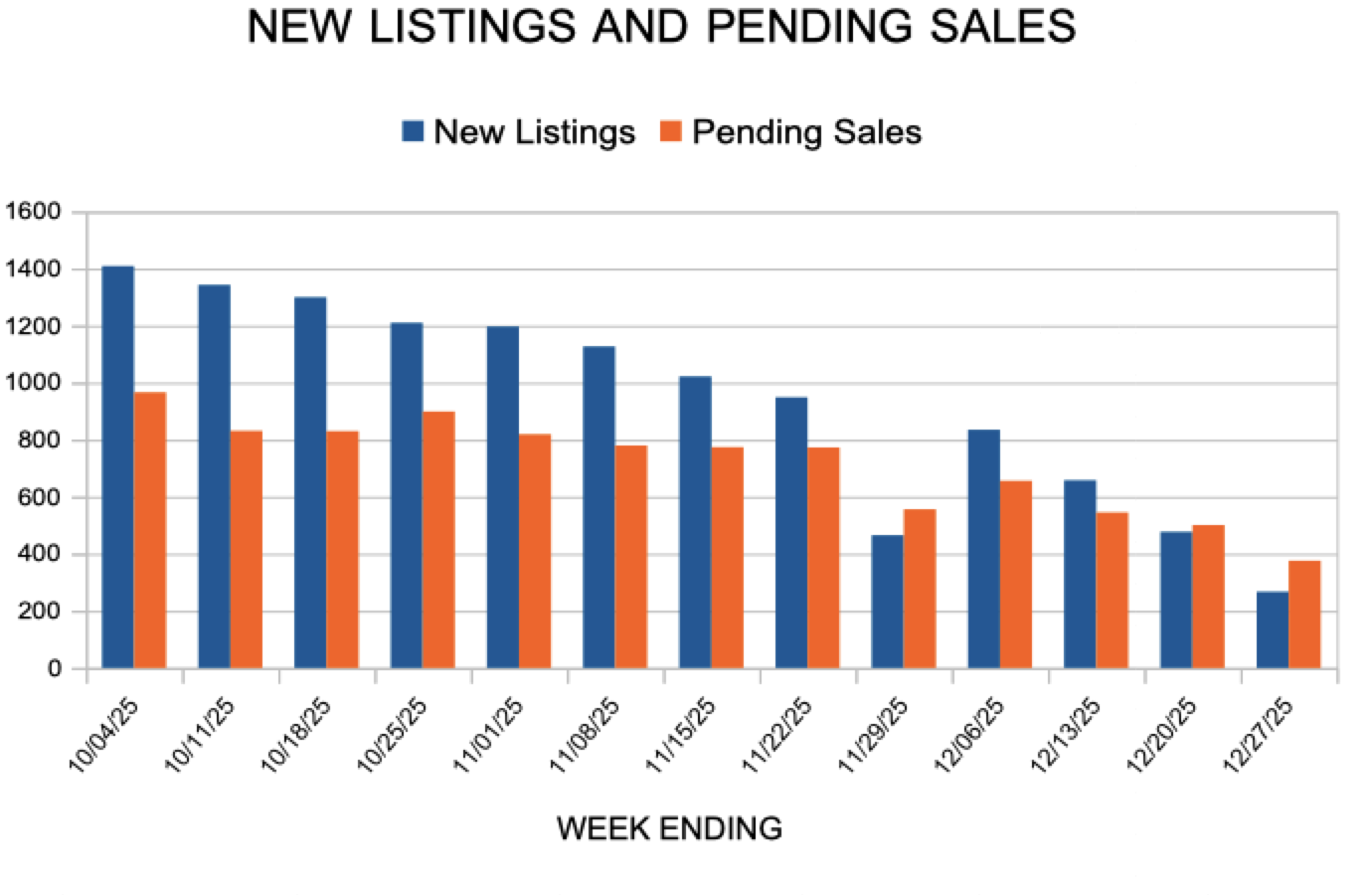

- New Listings decreased 18.9% to 586

- Pending Sales decreased 11.8% to 387

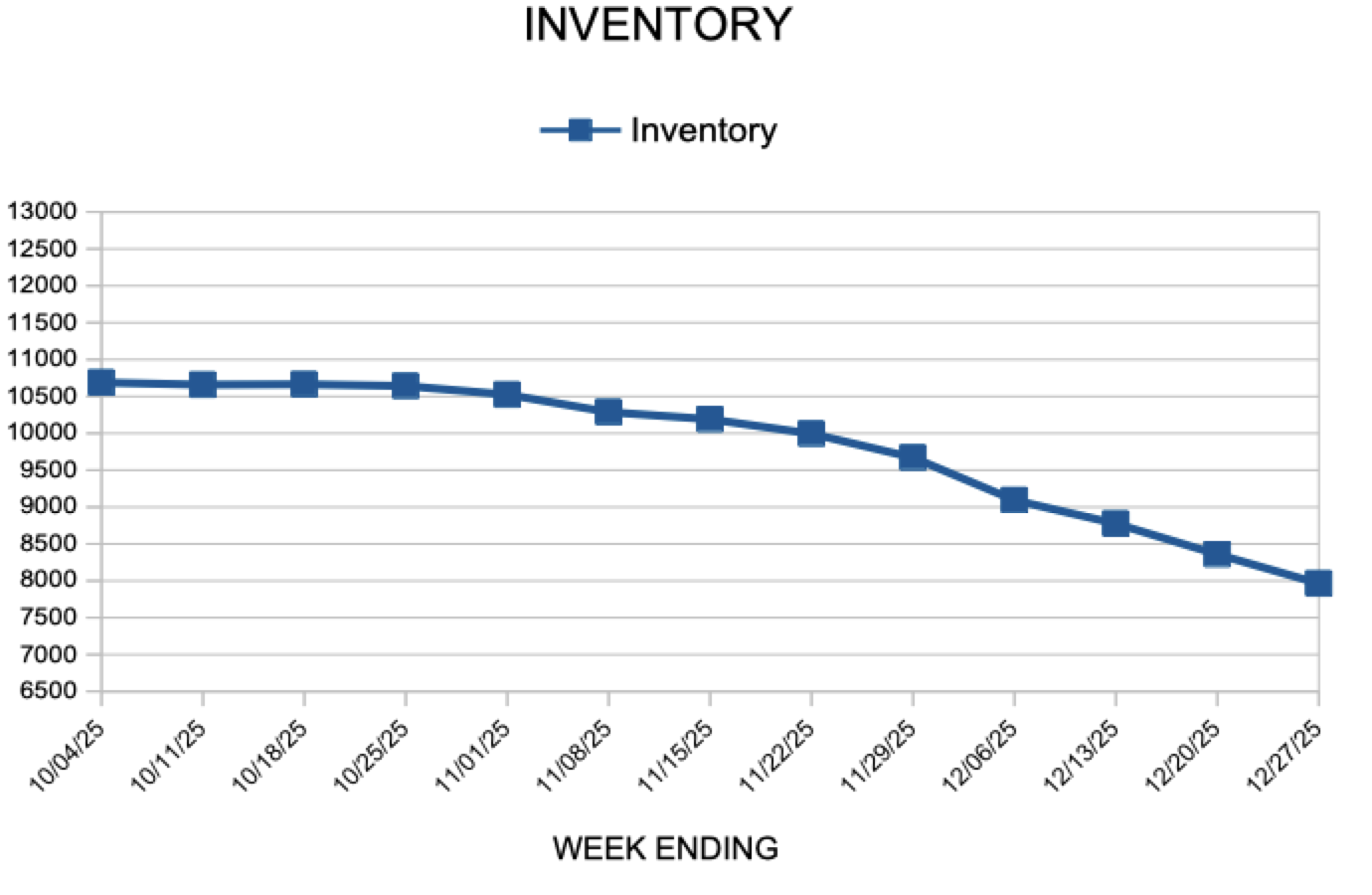

- Inventory decreased 2.6% to 7,683

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 2.9% to $387,000

- Days on Market remained flat at 50

- Percent of Original List Price Received decreased 0.2% to 97.4%

- Months Supply of Homes For Sale remained flat at 2.5

All comparisons are to 2025

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Stable, Purchase Demand Rising

January 8, 2026

In the first full week of the new year, mortgage rates remained within a narrow range, hovering close to the 6% mark. The combination of solid economic growth and lower rates has led to improving momentum in for-sale residential demand, with purchase applications up over 20% from a year ago.

- The 30-year fixed-rate mortgage averaged 6.16% as of January 8, 2026, up slightly from last week when it averaged 6.15%. A year ago at this time, the 30-year FRM averaged 6.93%.

- The 15-year fixed-rate mortgage averaged 5.46%, up from last week when it averaged 5.44%. A year ago at this time, the 15-year FRM averaged 6.14%.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

- 1

- 2

- 3

- …

- 183

- Next Page »