For Week Ending March 25, 2023

For Week Ending March 25, 2023

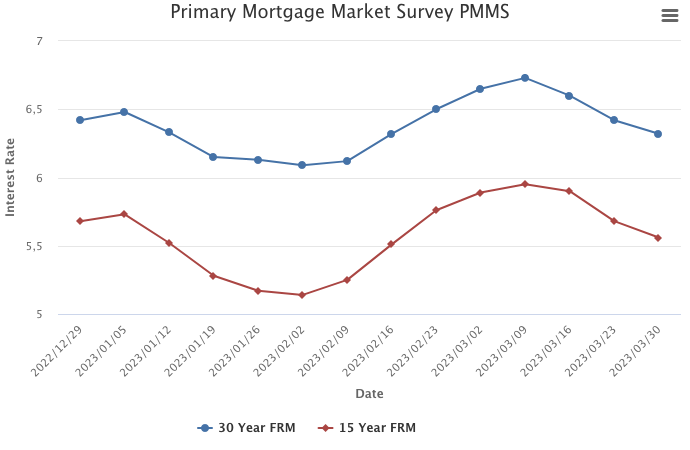

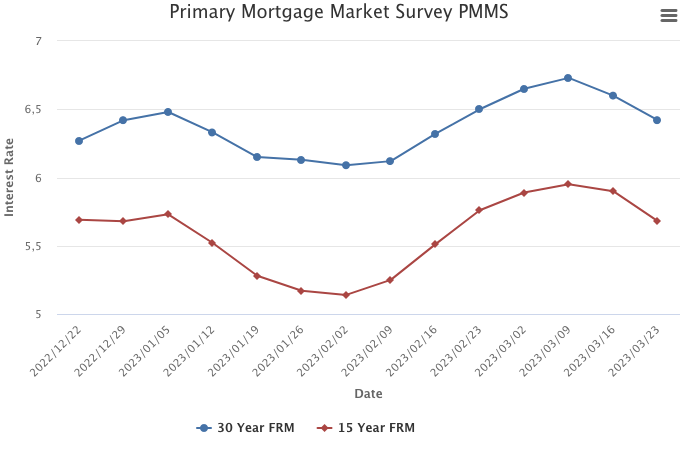

Mortgage interest rates declined for the third week in a row, with the 30-year fixed rate mortgage averaging 6.32% the week ending 3/30/23, the lowest level since mid-February, according to Freddie Mac. The drop in rates has led to an increase in mortgage demand, with mortgage applications to purchase a home rising 2% from the previous week, marking the fourth consecutive week home purchase applications increased, according to the Mortgage Bankers Association.

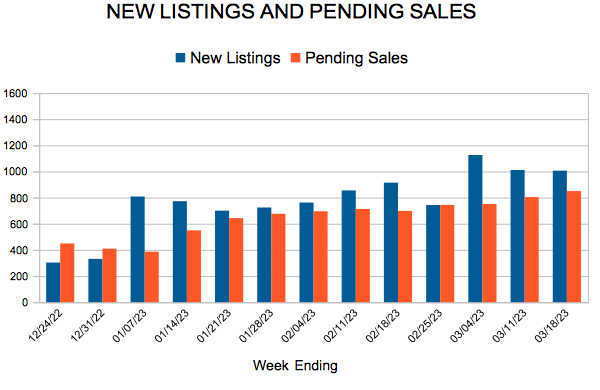

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MARCH 25:

- New Listings decreased 28.1% to 1,035

- Pending Sales decreased 28.4% to 846

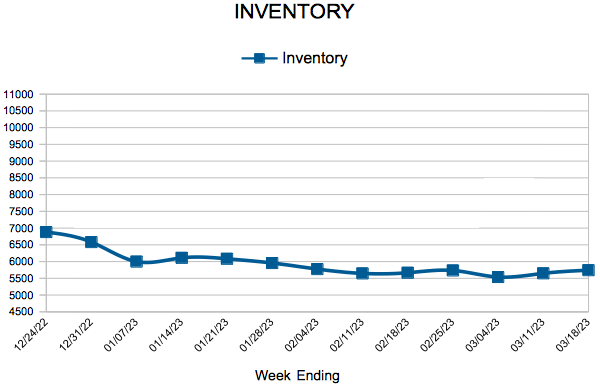

- Inventory increased 9.2% to 5,799

FOR THE MONTH OF FEBRUARY:

- Median Sales Price increased 0.6% to $342,000

- Days on Market increased 38.6% to 61

- Percent of Original List Price Received decreased 3.6% to 97.2%

- Months Supply of Homes For Sale increased 44.4% to 1.3

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.