Weekly Market Report

For Week Ending October 11, 2025

For Week Ending October 11, 2025

Rising housing costs have led many young adults to delay moving out of their parents’ homes. According to the 2023 American Community Survey (ACS), 19.2% of adults aged 25 to 34 lived with a parent or parent-in-law in 2023—approximately 8.5 million people. Although down from a peak of 22% in 2017-2018, the share of young adults living with parents remains elevated compared to 2000, when fewer than 12% did so.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 11:

- New Listings decreased 4.3% to 1,343

- Pending Sales decreased 5.1% to 831

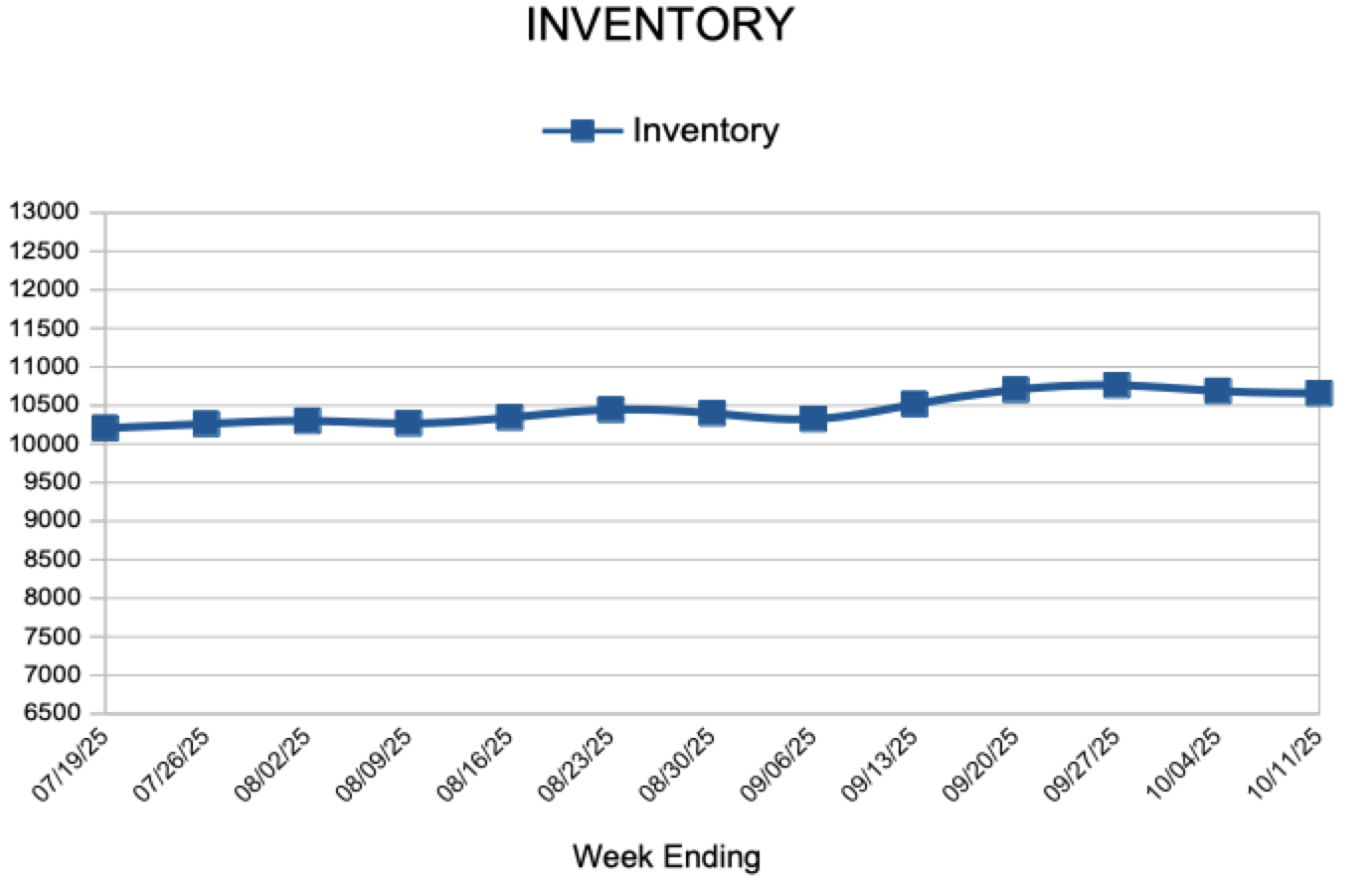

- Inventory decreased 0.2% to 10,659

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.6% to $390,000

- Days on Market increased 12.8% to 44

- Percent of Original List Price Received decreased 0.1% to 98.4%

- Months Supply of Homes For Sale decreased 3.4% to 2.8

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Decrease

October 16, 2025

Mortgage rates inched down this week and have held relatively steady over the past several weeks. Importantly, homeowners have noticed these consistently lower rates, driving an uptick in refinance activity. Combined with increased housing inventory and slower house price growth, these rates also are creating a more favorable environment for those looking to buy a home.

Information provided by Freddie Mac.

New Listings and Pending Sales

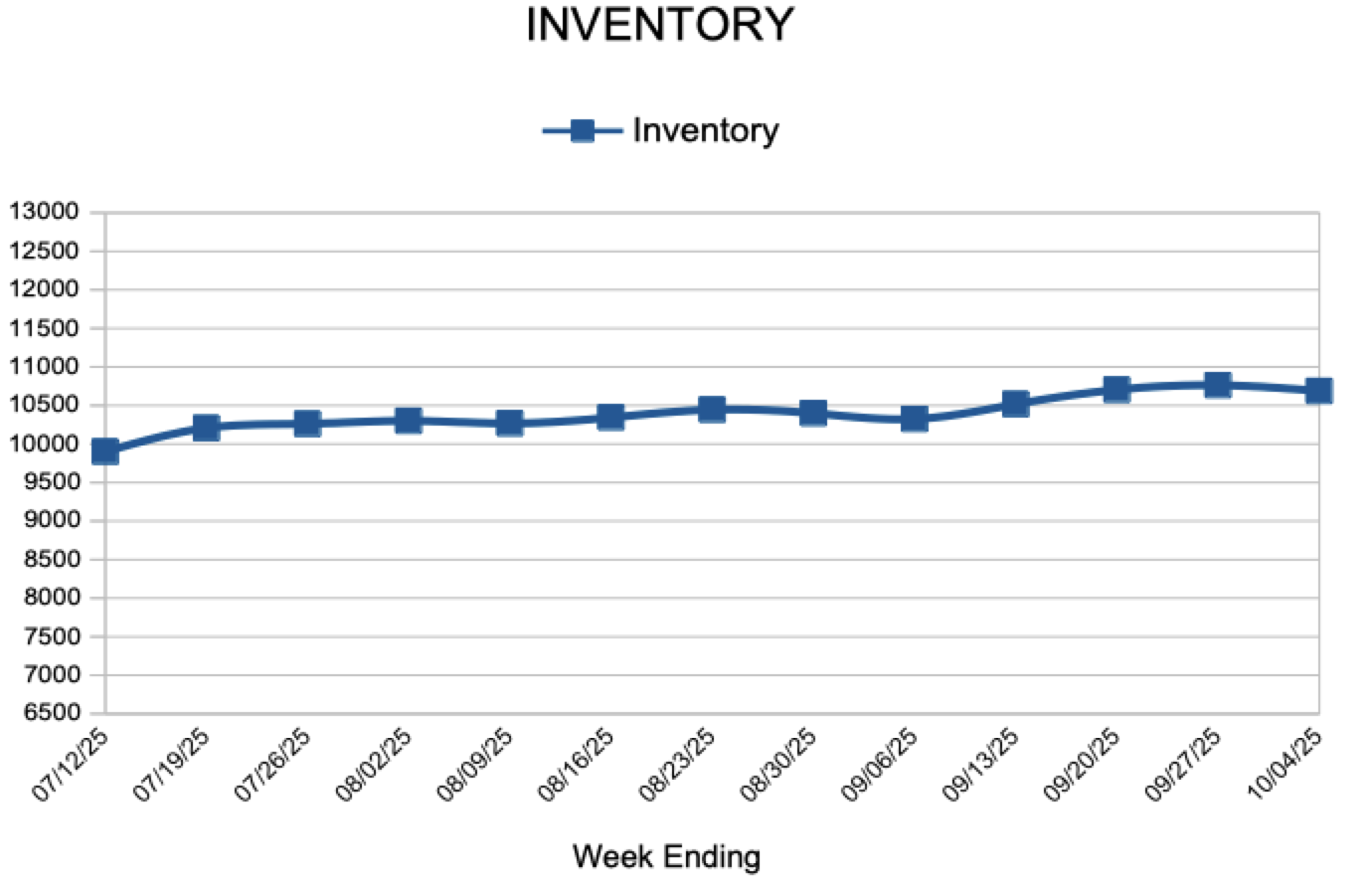

Inventory

Weekly Market Report

For Week Ending October 4, 2025

For Week Ending October 4, 2025

Nationally, the best time to buy a home is the week of October 12–18, according to a recent report from Realtor®.com. Historically, this week offers the most favorable conditions for buyers, with higher inventory levels, lower home prices, reduced competition, and a slower market pace. However, the optimal buying window varies across local markets. Some areas have already experienced peak buyer conditions, while others may not reach their ideal period until November or December.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 4:

- New Listings decreased 4.4% to 1,409

- Pending Sales decreased 5.7% to 966

- Inventory remained flat at 10,688

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.8% to $400,000

- Days on Market increased 5.0% to 42

- Percent of Original List Price Received remained flat at 98.7%

- Months Supply of Homes For Sale remained flat at 2.8

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 7

- 8

- 9

- 10

- 11

- …

- 182

- Next Page »