August 24, 2023

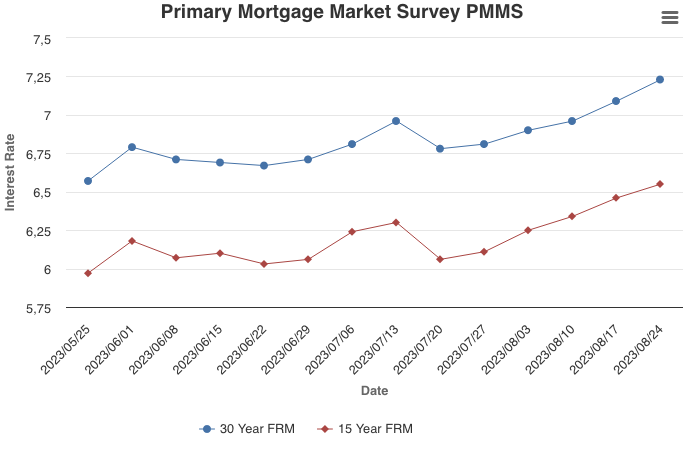

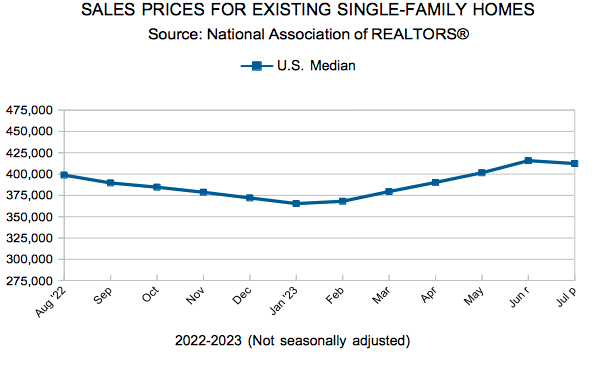

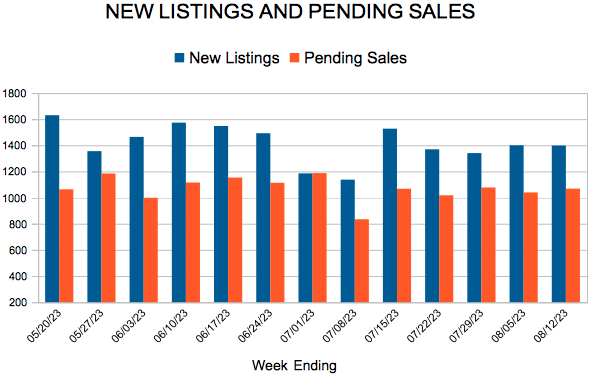

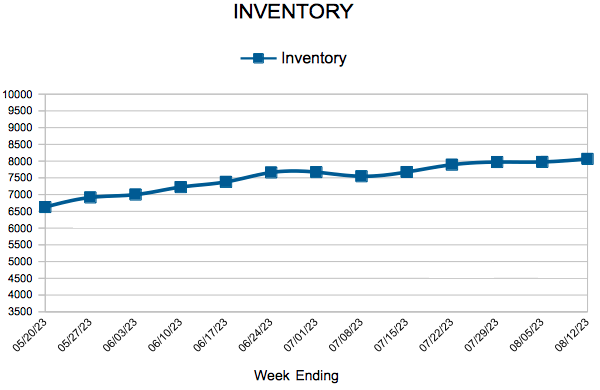

This week, the 30-year fixed-rate mortgage reached its highest level since 2001 and indications of ongoing economic strength will likely continue to keep upward pressure on rates in the short-term. As rates remain high and supply of unsold homes woefully low, incoming data shows that existing homes sales continue to fall. However, there are slightly more new homes available, and sales of these new homes continue to rise, helping provide modest relief to the unyielding housing inventory predicament.

Information provided by Freddie Mac.

For Week Ending August 12, 2023

For Week Ending August 12, 2023