Inventory

Weekly Market Report

For Week Ending January 2, 2021

For Week Ending January 2, 2021

The New Year has begun and with it, many buyers and sellers have a change of housing in their new year resolutions. While ongoing unemployment claims are still elevated, it is less than one quarter of what it was at its high during the early days of the pandemic. With interest rates remaining near record lows, the stock market near record highs, and inventory of homes available still constrained in most segments of the market, the year is setting up to be another filled with strong demand and limited supply.

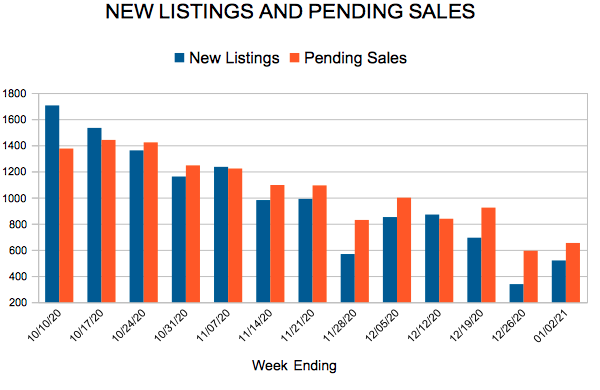

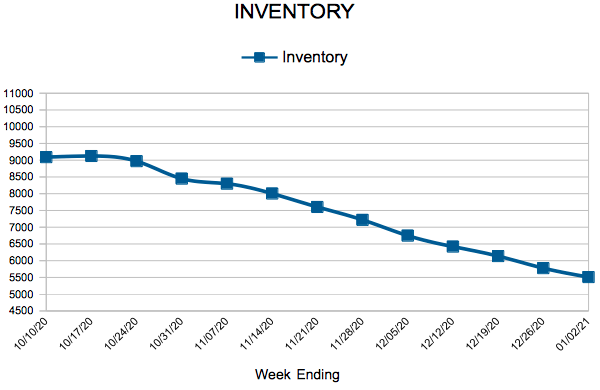

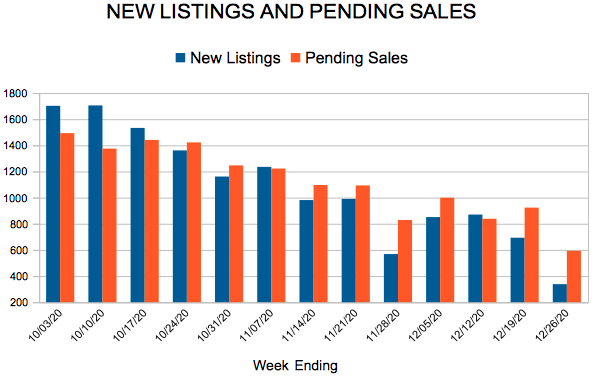

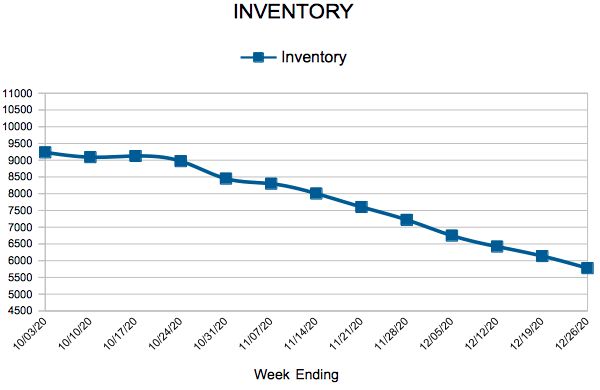

In the Twin Cities region, for the week ending January 2:

- New Listings decreased 25.8% to 519

- Pending Sales increased 17.0% to 653

- Inventory decreased 38.1% to 5,511

For the month of November:

- Median Sales Price increased 10.7% to $310,000

- Days on Market decreased 33.3% to 34

- Percent of Original List Price Received increased 2.8% to 100.2%

- Months Supply of Homes For Sale decreased 40.9% to 1.3

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

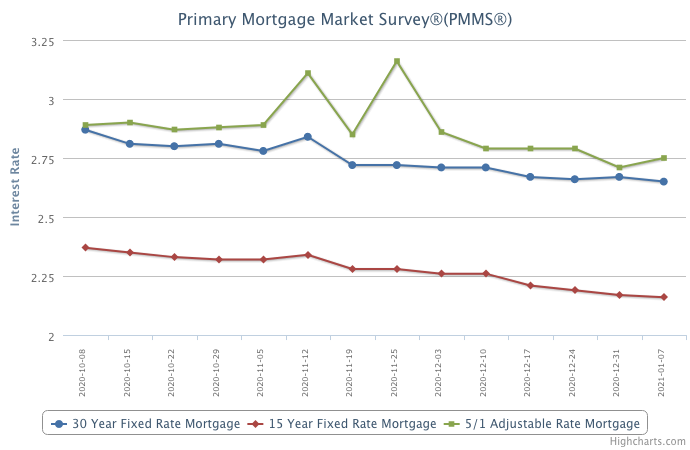

Mortgage Rates Hit a New Record Low the First Week of 2021

January 7, 2021

A new year, a new record low mortgage rate. Despite a full percentage point decline in rates over the past year, housing affordability has decreased because these low rates have been offset by rising home prices. However, the forces behind the drop in rates have been shifting over the last few months and rates are poised to rise modestly this year. The combination of rising mortgage rates and increasing home prices will accelerate the decline in affordability and further squeeze potential homebuyers during the spring home sales season.

Information provided by Freddie Mac.