Weekly Market Report

For Week Ending September 6, 2025

For Week Ending September 6, 2025

U.S. housing starts rose to a five-month high, climbing 5.2% month-over-month and 12.9% year-over-year to a seasonally adjusted annual rate of 1,428,000 units, according to the U.S. Census Bureau. The gain was driven primarily by multi-family starts, which surged 11.6% from the previous month to 470,000 units, while single family starts increased 2.8% to 939,000 units.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 6:

- New Listings increased 8.2% to 1,574

- Pending Sales increased 6.5% to 825

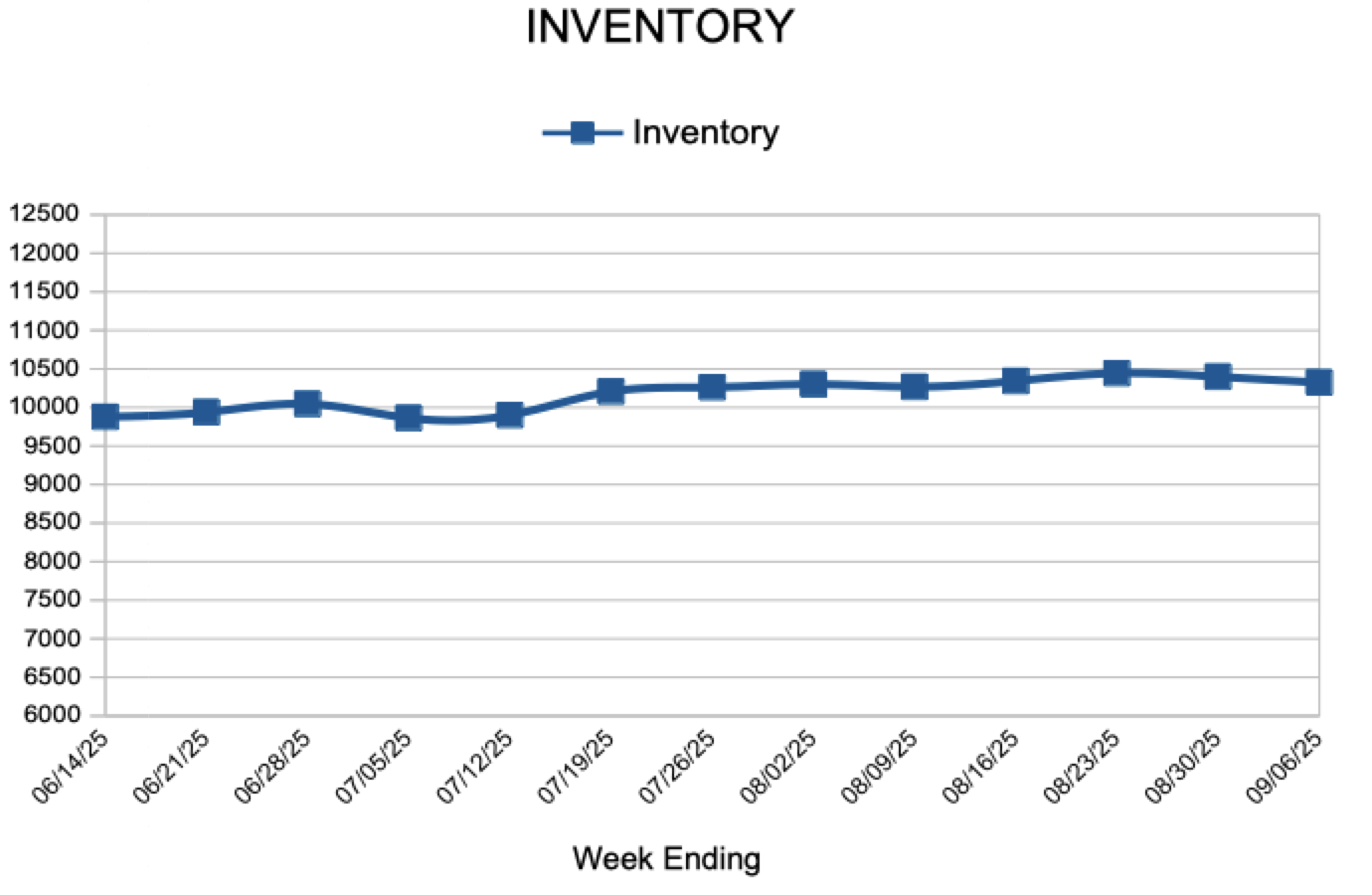

- Inventory increased 1.4% to 10,325

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.8% to $399,999

- Days on Market increased 5.0% to 42

- Percent of Original List Price Received remained flat at 98.7%

- Months Supply of Homes For Sale decreased 3.6% to 2.7/li>

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending August 30, 2025

For Week Ending August 30, 2025

Investors purchased 265,000 homes—nearly 27% of all homes sold—in the first quarter of 2025, according to a recent report from BatchData. That’s a 1.2% increase from the same period last year and represents the highest share in at least five years. Between 2020 and 2023, investors purchased an average of 18.5% of homes sold. Investor-owned properties now account for approximately 20% of the country’s 86 million single-family homes.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 30:

- New Listings increased 2.9% to 1,158

- Pending Sales increased 7.9% to 952

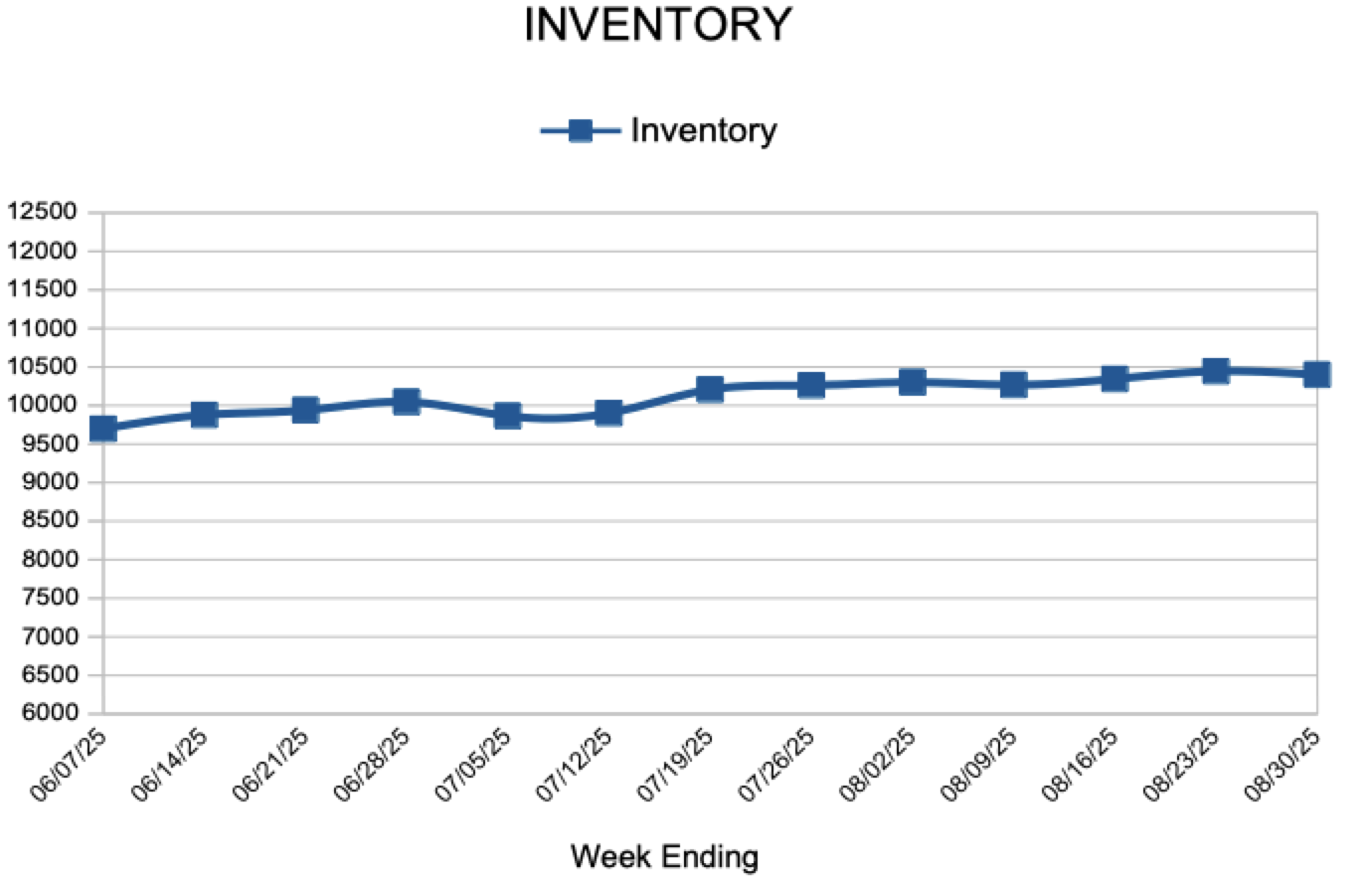

- Inventory increased 1.1% to 10,399

FOR THE MONTH OF JULY:

- Median Sales Price increased 2.6% to $395,000

- Days on Market increased 11.1% to 40

- Percent of Original List Price Received decreased 0.2% to 99.3%

- Months Supply of Homes For Sale remained flat at 2.7

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending August 23, 2025

For Week Ending August 23, 2025

According to Realtor®.com’s July 2025 Monthly Housing Market Trends Report, national housing inventory increased 24.8% year-over-year, with more than 1.1 million homes for sale in July. This marks the third consecutive month with over 1 million active listings. While this is encouraging news for buyers, total active listings remain 13.4% below typical 2017-2019 levels.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 23:

- New Listings increased 3.2% to 1,356

- Pending Sales increased 2.9% to 896

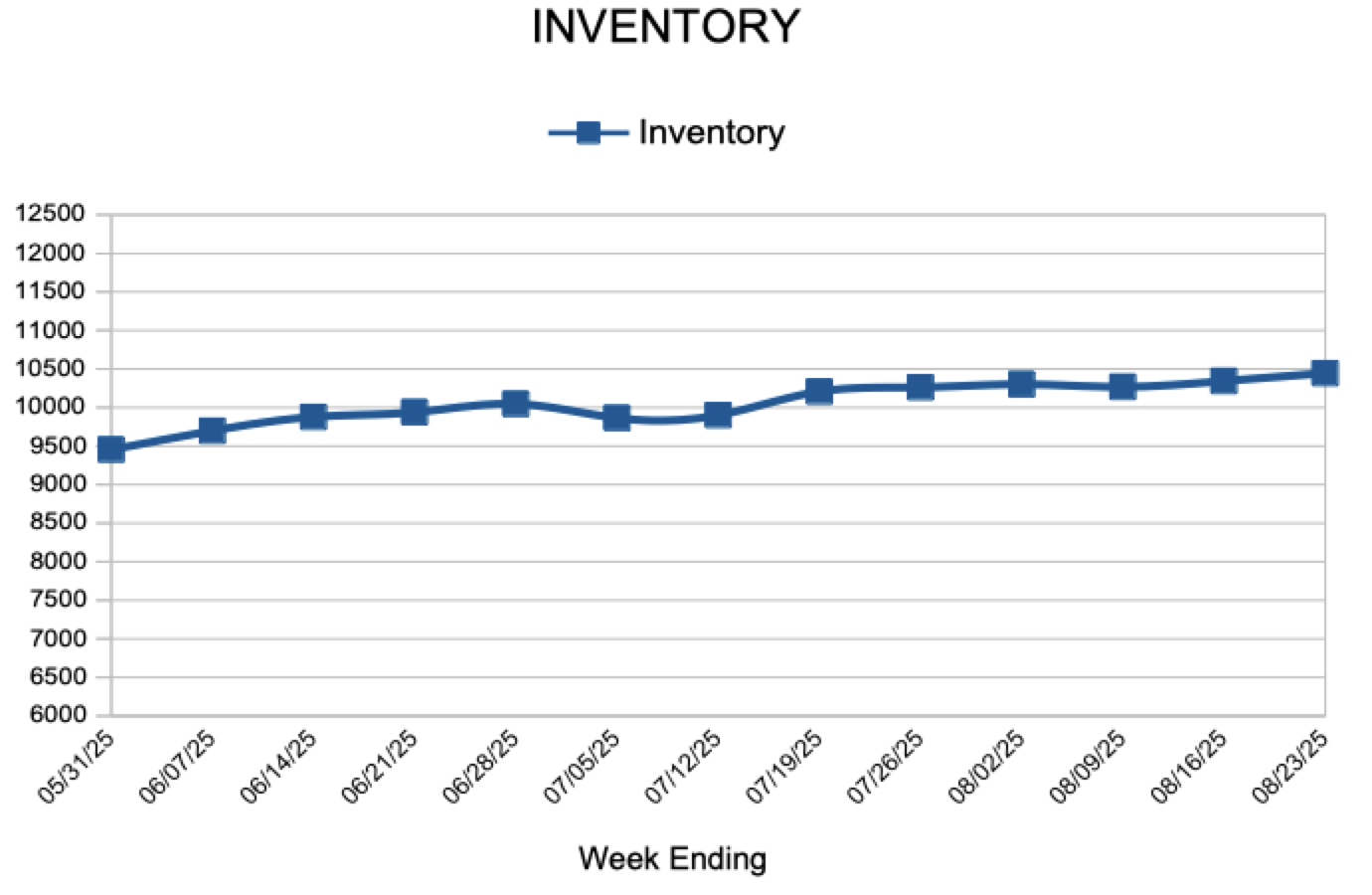

- Inventory increased increased 2.1% to 10,445

FOR THE MONTH OF JULY:

- Median Sales Price increased 2.6% to $395,000

- Days on Market increased 11.1% to 40

- Percent of Original List Price Received decreased 0.2% to 99.3%

- Months Supply of Homes For Sale remained flat at 2.7

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 4

- 5

- 6

- 7

- 8

- …

- 82

- Next Page »