For Week Ending May 14, 2022

For Week Ending May 14, 2022

With home prices and mortgage rates continuing to rise, down payments are increasing nationwide, as buyers aim to lower their monthly mortgage costs and make their offer more attractive to sellers. According to Realtor.com, buyers averaged a $28,000 down payment in the first quarter of 2022, averaging 13.1% of the purchase price, compared to the first quarter of 2020, when down payments averaged $14,000, with buyers paying about 11% of the purchase price.

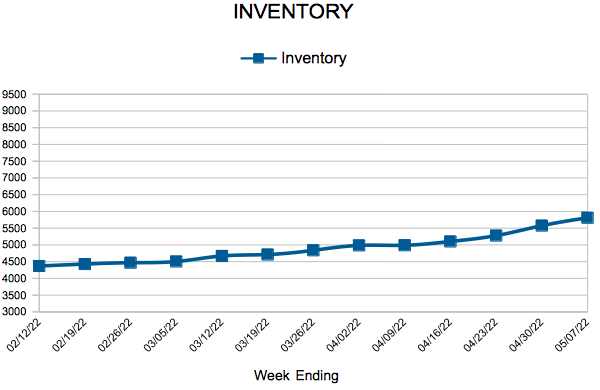

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 14:

- New Listings decreased 6.2% to 1,875

- Pending Sales decreased 19.3% to 1,280

- Inventory decreased 2.9% to 6,152

FOR THE MONTH OF APRIL:

- Median Sales Price increased 10.0% to $370,000

- Days on Market decreased 9.7% to 28

- Percent of Original List Price Received increased 0.5% to 103.8%

- Months Supply of Homes For Sale remained flat at 1.1

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending May 7, 2022

For Week Ending May 7, 2022

Demand for adjustable-rate mortgages (ARMs) is rising, as buyers look to mitigate higher monthly payments caused by record-high sales prices and surging mortgage interest rates. Although less popular than fixed rate mortgages, ARMs offer introductory rates lower than rates from conventional mortgages and currently represent 11% of mortgage loans, up from 3% at the beginning of the year, according to the Mortgage Bankers Association.

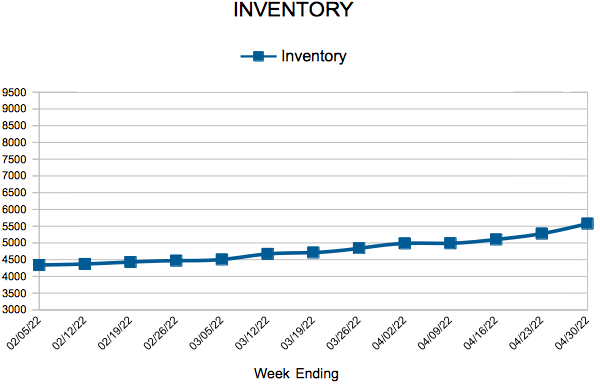

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 7:

- New Listings decreased 5.7% to 1,808

- Pending Sales decreased 11.6% to 1,406

- Inventory decreased 5.2% to 5,811

FOR THE MONTH OF APRIL:

- Median Sales Price increased 10.0% to $370,000

- Days on Market decreased 9.7% to 28

- Percent of Original List Price Received increased 0.5% to 103.8%

- Months Supply of Homes For Sale remained flat at 1.1

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending April 30, 2022

For Week Ending April 30, 2022

70% of metropolitan areas saw the median existing-home sales price rise by double digits annually in the first quarter of 2022, up from 66% of metro areas in the previous quarter, according to the National Association of REALTORS® (NAR) latest quarterly report. In 27 U.S. markets, buyers needed at least $100,000 annual income to afford a 10% down payment, with first time buyers typically spending 28.4% of monthly income on mortgage payments, exceeding the 25% threshold NAR considers unaffordable.

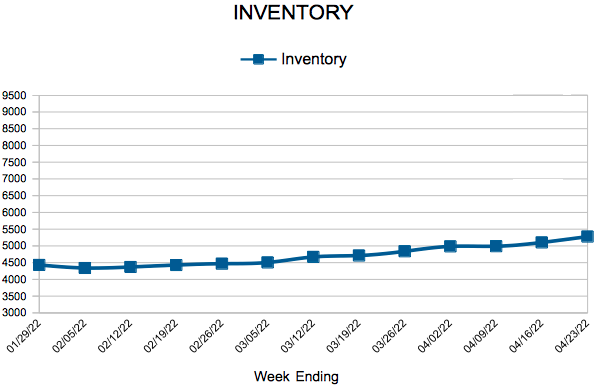

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 30:

- New Listings decreased 4.8% to 1,731

- Pending Sales decreased 9.3% to 1,424

- Inventory decreased 6.9% to 5,576

FOR THE MONTH OF MARCH:

- Median Sales Price increased 7.8% to $354,077

- Days on Market decreased 10.3% to 35

- Percent of Original List Price Received increased 0.8% to 102.7%

- Months Supply of Homes For Sale remained flat at 1.0

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

- « Previous Page

- 1

- …

- 48

- 49

- 50

- 51

- 52

- …

- 72

- Next Page »