Weekly Market Report

For Week Ending November 8, 2025

For Week Ending November 8, 2025

According to ResiClub’s analysis of the U.S. Census Bureau’s 2024 American Community Survey, 35 million, or 40.3%, of U.S. homeowners are mortgage-free, up from 39.8% in 2023. More than half of these homeowners (54%) are aged 65 or older, a group that represents just over a third (34.1%) of all U.S. homeowners, with 64% owning their homes outright.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 8:

- New Listings increased 9.8% to 1,127

- Pending Sales increased 5.4% to 780

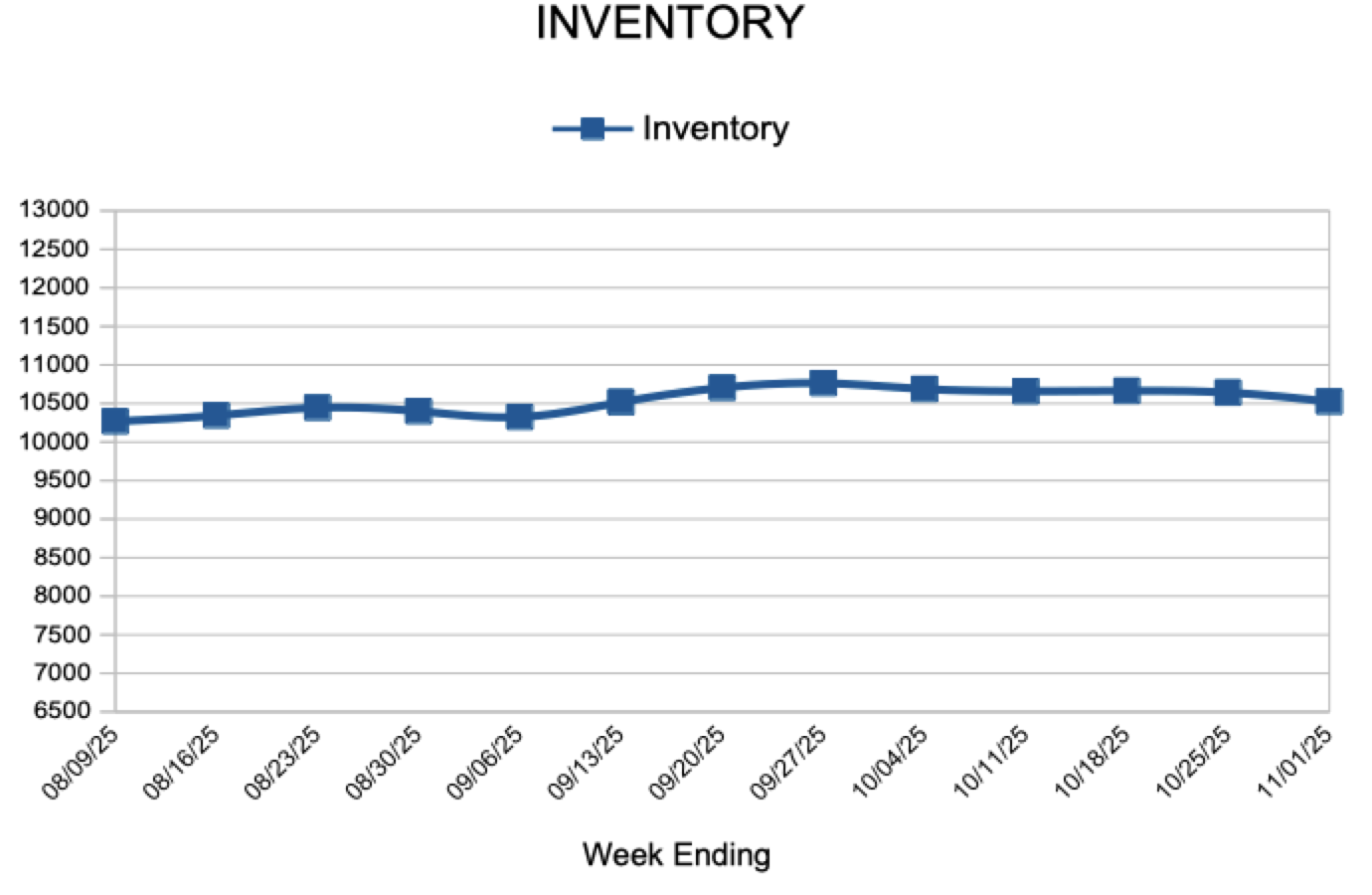

- Inventory increased 0.2% to 10,287

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 2.1% to $389,900

- Days on Market increased 6.7% to 48

- Percent of Original List Price Received increased 0.3% to 98.1%

- Months Supply of Homes For Sale decreased 3.6% to 2.7

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending November 1, 2025

For Week Ending November 1, 2025

U.S. homebuilder confidence rose five points to 37 in October, marking the highest

reading since April, according to the NAHB/Wells Fargo Housing Market Index

(HMI). Future sales expectations increased nine points to 54, surpassing the 50-

point mark for the first time since January. 38% of builders reported cutting prices

in October, with an average price reduction of 6%.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 1:

- New Listings increased 14.2% to 1,197

- Pending Sales decreased 5.5% to 819

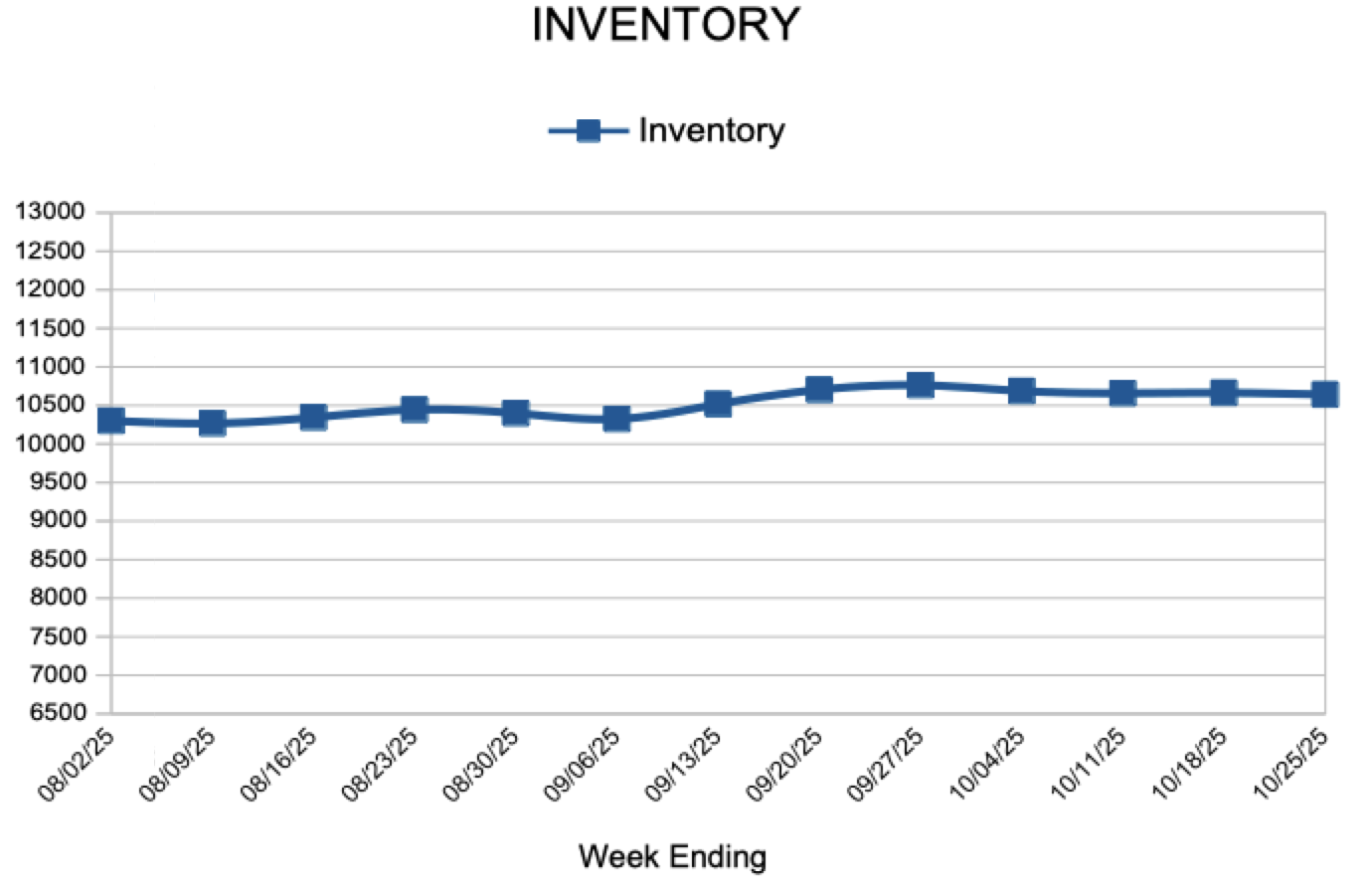

- Inventory decreased 0.9% to 10,524

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.6% to $390,000

- Days on Market increased 12.8% to 44

- Percent of Original List Price Received decreased 0.1% to 98.4%

- Months Supply of Homes For Sale decreased 3.4% to 2.8

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending October 25, 2025

For Week Ending October 25, 2025

According to Realtor®.com’s September 2025 Monthly Housing Market Trends Report, active listings nationwide rose 17% year-over-year, with the total number of homes for sale surpassing one million for the fifth consecutive month. Inventory in the South and West now exceeds pre-pandemic levels, while the Midwest and Northeast continue to lag behind. Nationally, housing supply remains 13.9% lower than pre-pandemic levels.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 25:

- New Listings increased 6.7% to 1,210

- Pending Sales increased 6.4% to 899

- Inventory decreased 0.5% to 10,641

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.6% to $390,000

- Days on Market increased 12.8% to 44

- Percent of Original List Price Received decreased 0.1% to 98.4%

- Months Supply of Homes For Sale decreased 3.4% to 2.8

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 82

- Next Page »