Weekly Market Report

For Week Ending October 29, 2022

For Week Ending October 29, 2022

Seller profits are beginning to ease, as home sales dip and sales prices soften nationwide. According to ATTOM, profit margins on median-priced single-family home and condo sales fell 3% from the second to the third quarter of 2022 in nearly 70% of the 186 metropolitan areas tracked, representing the largest quarterly decline since 2011. Despite the drop, investment returns remain historically high, with profits up compared to the same period last year.

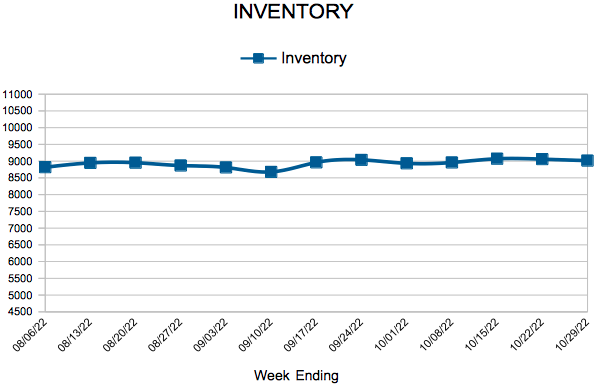

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 29:

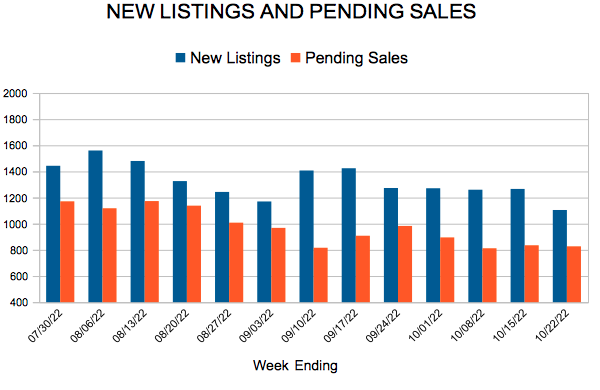

- New Listings decreased 21.7% to 1,055

- Pending Sales decreased 41.2% to 794

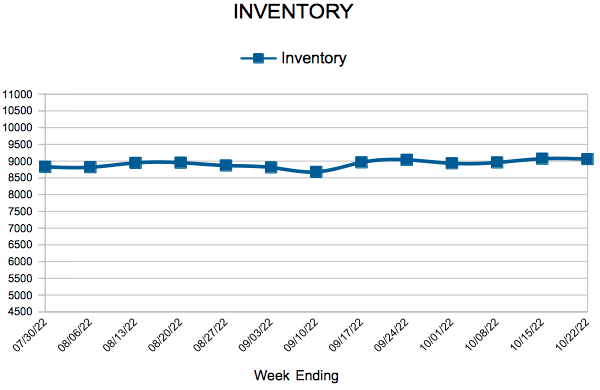

- Inventory increased 5.4% to 9,015

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 6.3% to $362,050

- Days on Market increased 39.1% to 32

- Percent of Original List Price Received decreased 2.3% to 98.9%

- Months Supply of Homes For Sale increased 18.8% to 1.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

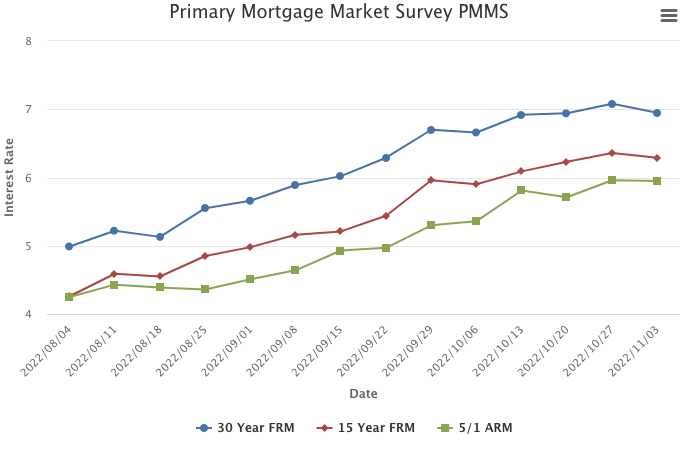

Mortgage Rates Dip Under Seven Percent

November 3, 2022

Mortgage rates continue to hover around seven percent, as the dynamics of a once-hot housing market have faded considerably. Unsure buyers navigating an unpredictable landscape keeps demand declining while other potential buyers remain sidelined from an affordability standpoint. Yesterday’s interest rate hike by the Federal Reserve will certainly inject additional lead into the heels of the housing market.

Information provided by Freddie Mac.

New Listings and Pending Sales

Weekly Market Report

For Week Ending October 22, 2022

For Week Ending October 22, 2022

As the housing market rebalances, many homeowners are finding they’re having to put more effort into selling their home to get the best deal possible compared to earlier in the pandemic, when conditions were different and a “For Sale” sign would often fetch multiple offers. Trends have changed, and with home sales down nationally, local REALTORS® are reporting a rise in price reductions, seller concessions, and homebuying contingencies, with a growing number of sellers needing to make repairs prior to sale.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 22:

- New Listings decreased 20.8% to 1,105

- Pending Sales decreased 34.2% to 827

- Inventory increased 4.6% to 9,059

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 6.3% to $362,100

- Days on Market increased 39.1% to 32

- Percent of Original List Price Received decreased 2.3% to 98.9%

- Months Supply of Homes For Sale increased 18.8% to 1.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 93

- 94

- 95

- 96

- 97

- …

- 147

- Next Page »