For Week Ending October 7, 2023

For Week Ending October 7, 2023

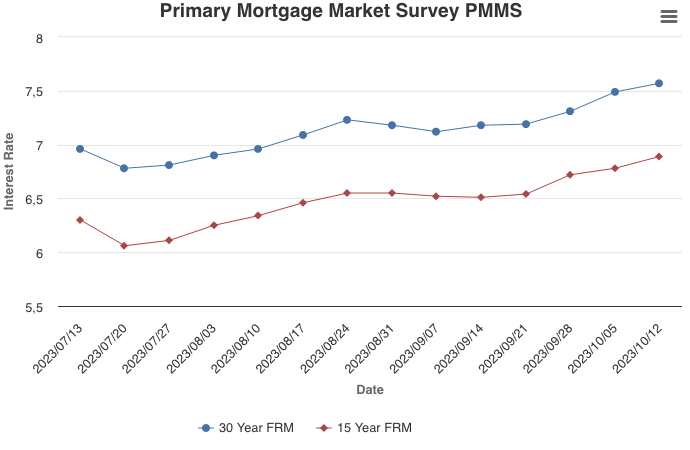

Adjustable-rate mortgages (ARM) continue to grow in popularity as prospective homebuyers aim to combat rising housing costs. Applications for 5/1 adjustable-rate mortgages rose 32.5% the week ending October 6 from four weeks earlier, according to the Mortgage Bankers Association. Effective rates for a 5/1 ARM averaged about 6.66% compared to 7.49% for a traditional 30-year fixed-rate mortgage, with the share of ARM applicants representing 9.2% of all borrowers, the highest percentage since November 2022.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 7:

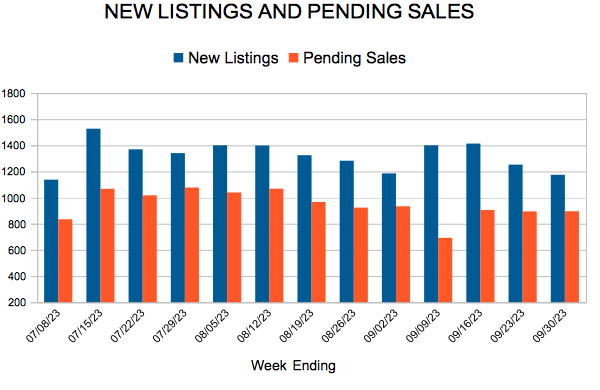

- New Listings decreased 4.4% to 1,226

- Pending Sales increased 2.3% to 836

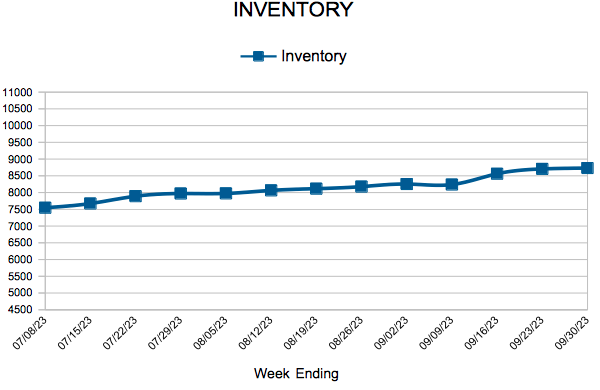

- Inventory decreased 7.7% to 8,740

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.3% to $370,805

- Days on Market increased 6.3% to 34

- Percent of Original List Price Received increased 0.4% to 99.3%

- Months Supply of Homes For Sale increased 20.0% to 2.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.