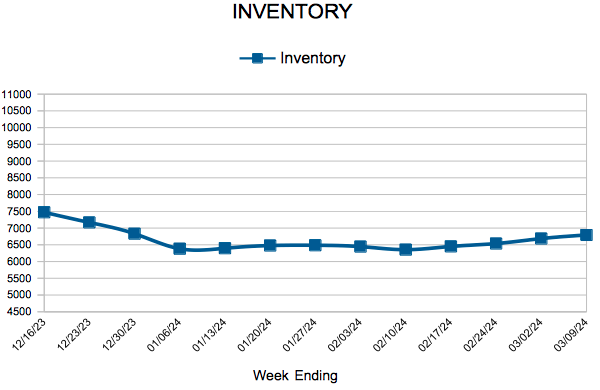

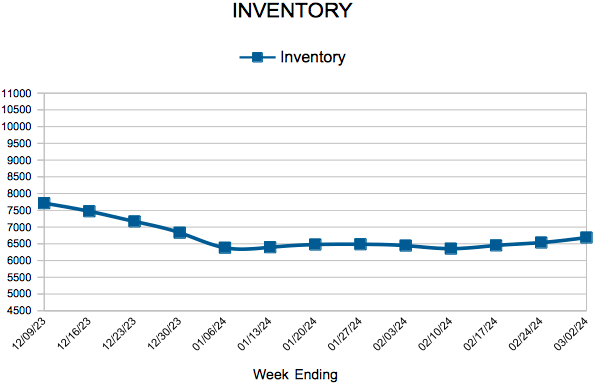

Inventory

Weekly Market Report

For Week Ending March 9, 2024

For Week Ending March 9, 2024

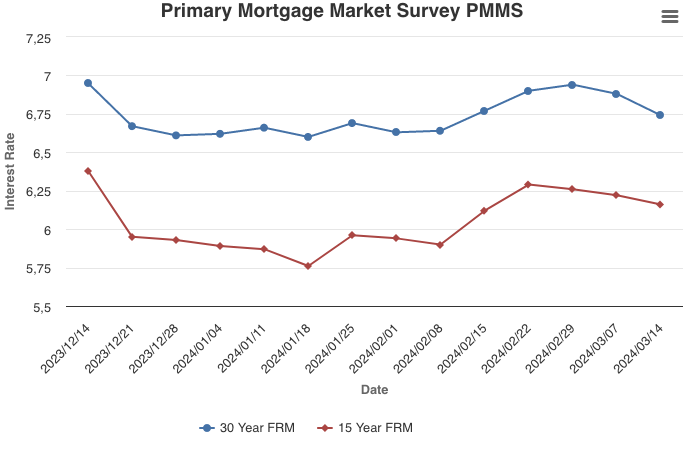

Mortgage rates fell for the first time in five weeks, as the average 30-year fixed rate mortgage slid 0.06 percentage points to 6.88% the week ending March 7, 2024, according to Freddie Mac. The decline in rates helped mortgage applications increase 7.1% on a seasonally adjusted basis from the previous week, according to the Mortgage Bankers Association, while applications to purchase a home were up 5% from the previous week.

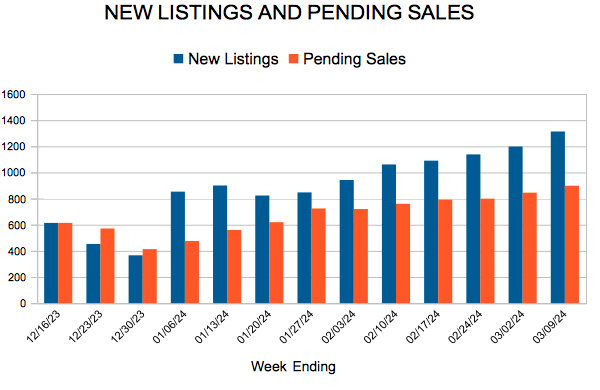

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MARCH 9:

- New Listings increased 24.9% to 1,313

- Pending Sales increased 11.6% to 898

- Inventory increased 11.9% to 6,793

FOR THE MONTH OF FEBRUARY:

- Median Sales Price increased 4.6% to $358,000

- Days on Market decreased 3.3% to 59

- Percent of Original List Price Received increased 0.3% to 97.5%

- Months Supply of Homes For Sale increased 28.6% to 1.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Continue to Decrease

March 14, 2024

The 30-year fixed-rate mortgage decreased again this week, with declines totaling almost a quarter of a percent in two weeks’ time. Despite the recent dip, mortgage rates remain high as the market contends with the pressure of sticky inflation. In this environment, there is a good possibility that rates will stay higher for a longer period of time.

Information provided by Freddie Mac.

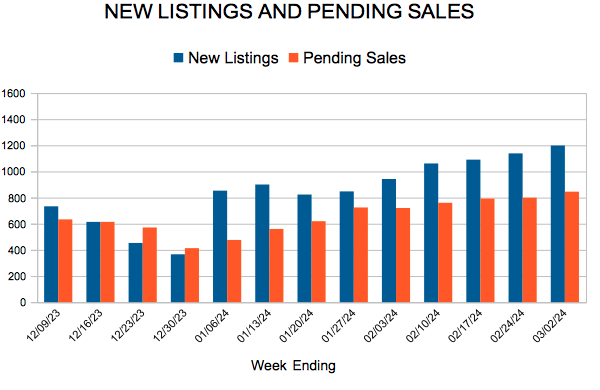

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 39

- 40

- 41

- 42

- 43

- …

- 147

- Next Page »