June 23, 2022

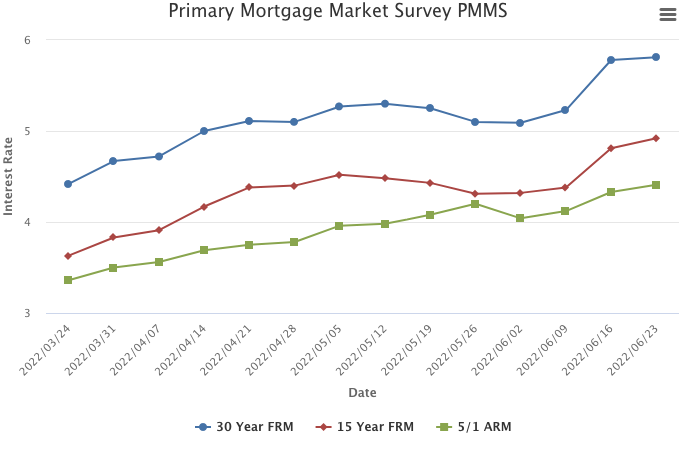

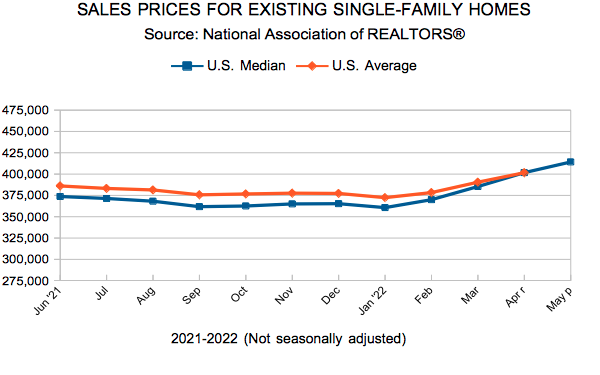

Fixed mortgage rates have increased by more than two full percentage points since the beginning of the year. The combination of rising rates and high home prices is the likely driver of recent declines in existing home sales. However, in reality many potential homebuyers are still interested in purchasing a home, keeping the market competitive but leveling off the last two years of red-hot activity.

Information provided by Freddie Mac.

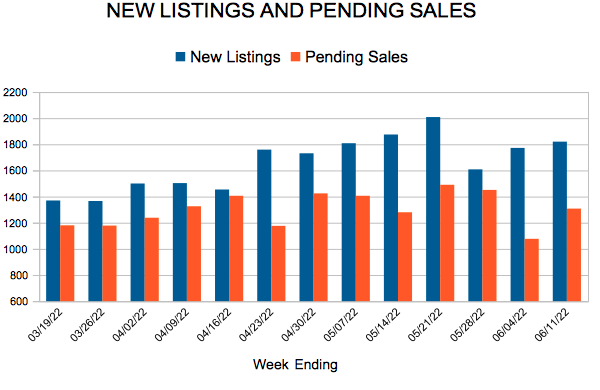

For Week Ending June 11, 2022

For Week Ending June 11, 2022