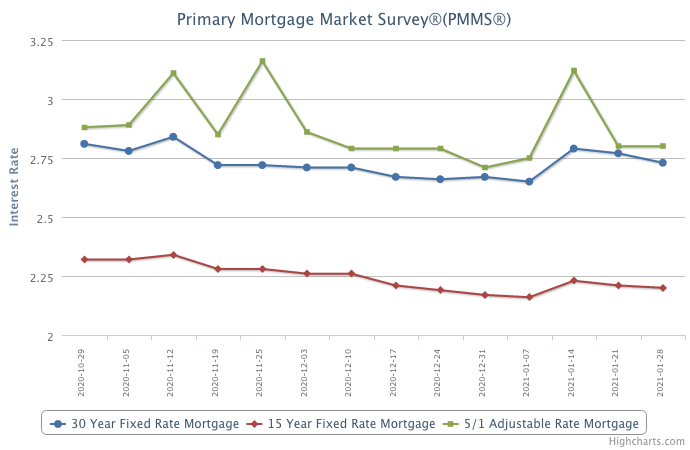

December is normally one of the slowest months of the year, but strong buyer demand across most segments of the market, buoyed by near record-low interest rates, continues to drive a healthy sales pace in the face of a new wave of COVID-19 infections and a softening job market.

Mortgage Rates Move Down

January 28, 2021

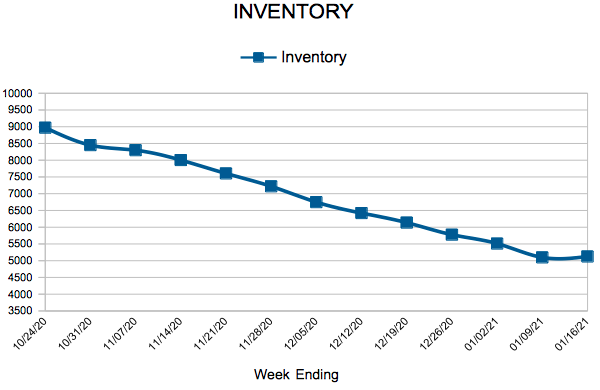

As the market reacts to a new administration in Washington and COVID-19 driven economic malaise, mortgage rates continued to decrease this week, just slightly. Even as house prices increase at the fastest rate we’ve seen in years, competition to buy is strong given the low inventory that exists across the country. The fact that there are not enough homes to meet demand is going to be an ongoing issue for the foreseeable future.

Information provided by Freddie Mac.

Despite the headwinds, 2020 was a record-breaking year for housing

Seller activity rose a modest 0.1 percent from 2019 while closed sales were up 7.7 percent. That marks the highest sales figure since at least 2003 and the highest new listings count since 2016. Listing activity was constrained due to health concerns, remodeling activity, a lack of options and homeowners staying in their homes longer.

“Predictably, the result of record sales combined with ultra-low inventory meant rising prices and sellers accepting stronger offers in less time,” according to Tracy Baglio, President of the Saint Paul Area Association of REALTORS®.

Governor Walz’s shelter-in-place order paused market activity in April and May, which created pent-up demand that pushed the spring market into summer and the summer market into fall. Buyers were still more eager to purchase than sellers were to list, meaning multiple offers remained commonplace—particularly at the more affordable price points where the inventory shortage is even more pronounced.

“Despite several challenges, the Twin Cities housing market exceeded all expectations,” said Todd Walker, President of Minneapolis Area REALTORS®. “Inventory remained a hurdle, but homeowners have never had so much equity in their homes and buyers haven’t seen rates this low in 50 years, offsetting rising prices.”

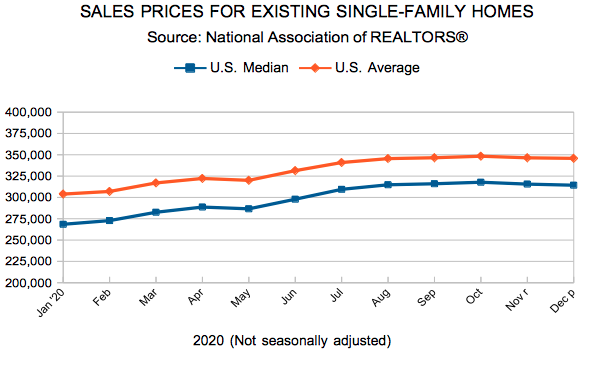

The median sales price rose 8.9 percent to $305,000, a record high. On average, sellers obtained 99.8 percent of their list price—the highest since at least 2003. Homes sold quickly. Half the sales had accepted offers in under 18 days. Importantly, all areas, price points and property types are unique.

Signed contracts rose 10.0 percent in Minneapolis and 16.4 percent in St. Paul, suggesting core cities remain attractive. With prices slightly lower, market times higher and offers weaker, the condo market continues to lag other segments. Aided by favorable jumbo rates and a recovered stock market, sales of luxury properties ($1M+) have been soaring higher—up 25.4 percent from 2019.

One thing is clear: the housing market continues to outperform, despite several headwinds.

2020 by the numbers (compared to 2019)

• Sellers listed 76,348 properties on the market, a 0.1 percent increase from 2019

• Buyers closed on 64,479 properties, up 7.7 percent (65,770 pending sales, up 9.7 percent)

• The Median Sales Price rose 8.9 percent to $305,000

• Inventory levels fell 39.3 percent to 5,080 units

• Months Supply of Inventory was down 47.1 percent to 0.9 months (5-6 months is balanced)

• Days on Market decreased 12.2 percent to 43 days, on average (median of 18, down 21.7 percent)

• Changes in Sales activity varied by market segment

- Single family sales were up 10.8 percent; condo sales fell 10.6 percent; townhome sales increased 3.4 percent

- Traditional sales rose 8.4 percent; foreclosure sales were down 20.9 percent; short sales fell 25.9 percent

- Previously owned sales were up 7.3 percent; new construction sales climbed 14.1 percent

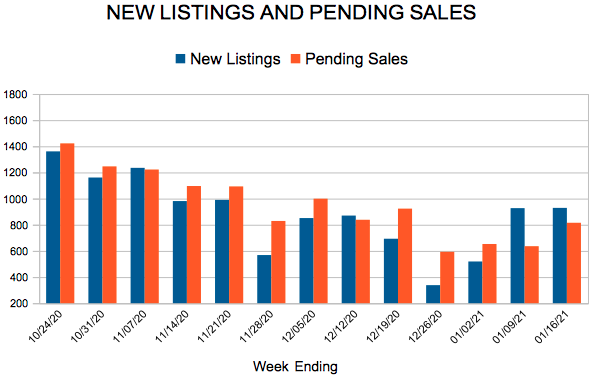

New Listings and Pending Sales

Inventory

Existing Home Sales

- « Previous Page

- 1

- …

- 4

- 5

- 6

- 7

- 8

- 9

- Next Page »